The Payment Card Industry Data Security Standard (PCI DSS) is active in protecting payment data. In today’s high-stakes cybersecurity arena, the dynamic evolution of its compliance requirements is key.

PCI DSS v4.0 section 5.4 requires any business that handles payment card information to have anti-phishing mechanisms in place by March 2025.

A security flaw in how email was designed puts your business at risk of impersonation, phishing, and spoofing attacks. The PCI DSS v4.0 aims to protect your organization and its stakeholders from these threats.

of cybercrimes are initiated with an email

of phishing attacks arrive via email

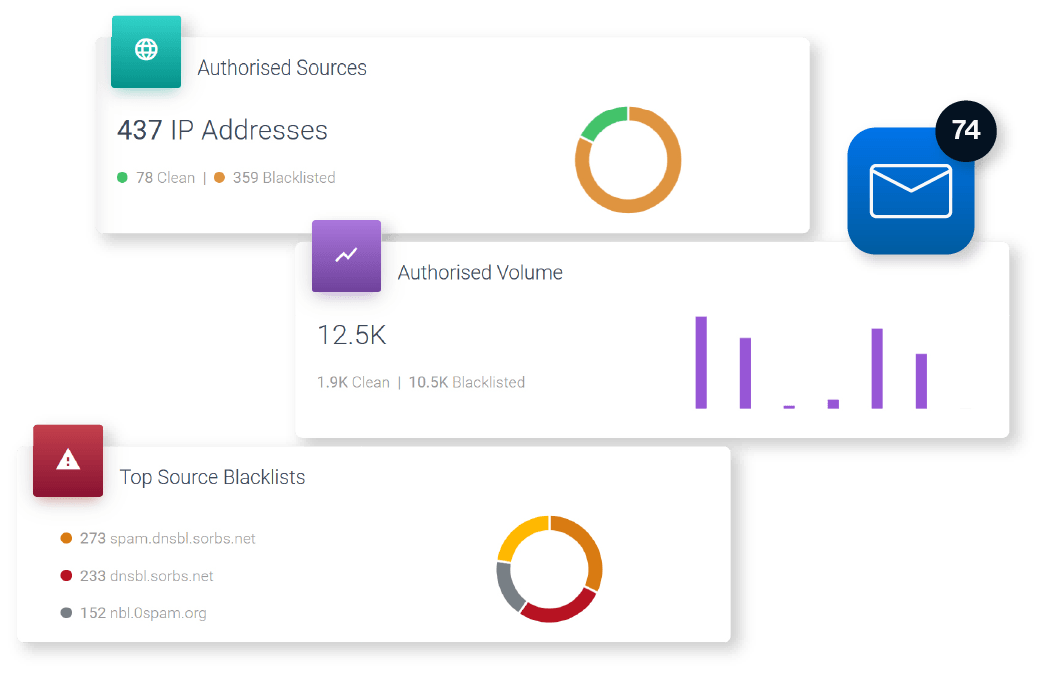

If a cybercriminal takes advantage of vulnerabilities in your email security, your business could suffer irreparable damage. Implement DMARC, the global email authentication standard that encompasses SPF and DKIM to ensure that only real email from your brand ever reaches a recipient’s inbox.

It’s also strongly recommended by the PCI Security Standards Council (PCI SSC) as a solution to compliance with PCI DSS section 5.4.

*For customers on Sendmarc’s Premium Plan. Subject to the conditions of our Fair Usage Policy.

Kim Sim

Chief Information Officer – Mr Price Group

“Centralizing compliance controls within the IT infrastructure has effectively reduced shadow IT instances while streamlining configurations. This has alleviated the burden on security specialists, allowing them to focus on core responsibilities. Furthermore, Sendmarc has provided exceptional one-on-one support, ensuring a seamless experience.”

Ashlen Naicker

Former Head of Digital and ICT

“Their advanced DMARC solution has shielded our business from phishing attacks and email fraud while also providing us with unparalleled insights into our email traffic. Sendmarc’s powerful platform has ensured that only legitimate emails are sent on our behalf. Their user-friendly interface and expert support have made DMARC implementation seamless, even for our non-technical team members. The peace of mind Sendmarc provides is immeasurable, as we now know that our clients and stakeholders can trust the authenticity of our emails.”

Derek Middleton

Systems Engineer at the Way Forward IT

“Sophisticated platform, knowledgeable staff, flexibility to adjust and tweak as needed.”

Tristan Warner

Co-Founder & Chief Innovation Officer at eNerds

“They live and breathe their mission to make the internet safer. Simple and feature-rich solution that’s easily understandable.”

Shailendra Harri

Business Development Manager at CHM Vuwani

“Sendmarc offers very powerful and simple solutions to very real problems our customers face. Their technology is excellent and their team is among the best in the industry.”

Brian Timperley

Co-Founder and CEO at Turrito Networks

“Sendmarc solves a real business problem and is an easy sale. They’re passionate about their mission to make the internet a safer place. The platform’s easy to use, and implementation is simple. The team manages the entire solution to ensure 100% success and has a 90-day guarantee to get your domain to 5 out of 5.”

Brian Tarr

CEO at Data Eco

“We’ve had the privilege of working with the Sendmarc team for a few months. They are highly responsive and truly curious. They want to make sure things are right and they care about us as a partner.”

Matthew Bookspan

CEO at Blacktip IT Services